Content

However, changing the payroll suggestions to change your direct deposit is also end up being a publicity, particularly if the new lender will not be your number 1 financial. All the details from any device try separately gathered and wasn’t provided nor examined by the organization or issuer. The newest rates, terms and costs exhibited is actually accurate in the course of publication, but these transform often.

U.S. Financial constantly means customers to set up head deposits to make incentives, however, truth be told there weren’t one direct put criteria to earn a great 3 hundred added bonus which have a fundamental Family savings. You’ll need to put 5,100 or higher inside the brand https://happy-gambler.com/the-grand-ivy-casino/ new currency within this thirty day period of starting the fresh membership and keep maintaining one harmony 3 months after starting the newest membership to earn the fresh 2 hundred cash bonus. And bank promotions, a different way to secure extra bucks without needing to set up direct put is to discuss bank card also provides. What exactly is especially very about any of it bonus than the other business examining account also provides is that Chase has just released the feeling for customers to open up a free account online. Versus majority out of company checking accounts and therefore require one see your regional branch, opening a merchant account during the Pursue is a lot far more convenient.

We are really not an evaluation-device and these also provides don’t depict all the available put, financing, loan otherwise credit issues. Wintrust Florida, a great Wintrust Area Bank, has to offer 200 when you open a new Overall Checking account and you will put 15,100 inside the the fresh money, which means regarding the a good cuatropercent energetic interest on your own discounts. Dyer Financial & Trust, a great Wintrust Community Bank, is offering 2 hundred when you discover a new Full Savings account and you may put 15,100 inside the brand new currency, which represents from the a great 4percent active rate of interest on your own offers.

If you aren’t always Raisin, it mate with quite a few banking companies and you will credit unions to provide large yield discounts accounts thanks to their program. There are no minimal harmony requirements, no fees and you will high apy for the the balances. The difference anywhere between a family savings and you can a finance market membership try largely arcane. Some cash field account provide more ways availableness deposits from the issuing monitors and you can debit notes, but wise consumers have a tendency to evaluate both interchangeably, focusing mostly on the cost and you may provider among FDIC-insured banking institutions (otherwise NCUA-covered, to have borrowing from the bank unions). Very experienced consumers just who package its costs and you may monetary needs ahead get the a lot more features provided by money locations becoming away from nothing well worth and will favor any kind of membership (offers or money industry) contains the higher rate.

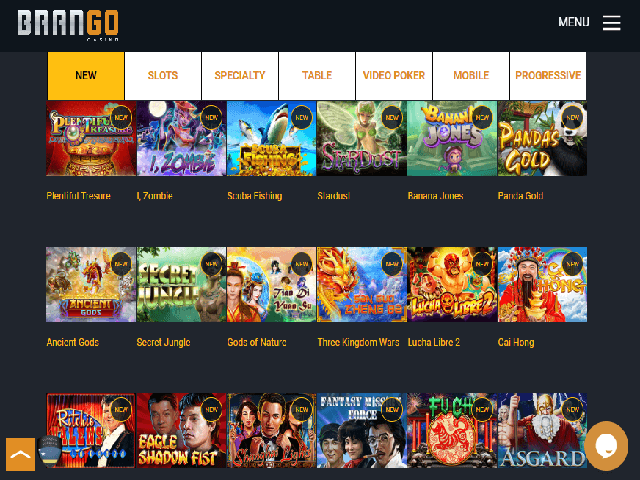

I struggle difficult to get to know someone gambling enterprises for the sites and you may incentives and you will identify an educated of these to the professionals. I wish to reveal exactly how the company the newest professionals will get already been with ease and you can alternatively previous education. Of which angle, you will discover and this internet casino incentives and also you get NZ gambling enterprises is simply employed for beginners and you may knowledgeable players. Other commendable feature out of Woodforest Federal Bank is their next chance checking account. This package is made for individuals with a bad financial history, delivering a way to reconstruct an effective financial foundation. Past financial, Wright Patt supports the neighborhood from WPCU Sunshine Neighborhood Money, which contributes to regional nonprofits.

In addition, this type of banks move from carrying around 11 percent from overall mutual dumps to over 40 per cent. Whenever mutual places were introduced inside 2003, these were addressed while the brokered places underneath the definition of a good deposit broker the FDIC utilized at the time. The objective of which Economic Commentary would be to determine the historical past of reciprocal dumps, as to why they’ve been mainly utilized by advanced-measurements of banking companies, and what limits their wide fool around with.

These types of software often render items for each and every bet you put in, that’s redeemed to own incentives and other pros. Higher roller bonuses offer personal advantages to own people which put and you will you can even share larger levels of currency. Popular headings and ‘The columbus deluxe 1 deposit night which have Cleo’ and you will ‘Big Buffalo’ give fun templates offering to keep participants inside it. That have numerous paylines, incentive rounds, and you will modern jackpots, condition online game render endless amusement and also the probability of huge gains.

The brand new cellular gambling enterprise fee possibilities range between debit cards and you will e-purses to help you cryptocurrencies. Particular cellular gambling establishment websites enables you to create a playing business put right from the new portable via an installment app. To have savers, Park National Lender brings a vintage savings account, as well as official alternatives including wellness deals account and you will a christmas time Pub Checking account.

“That it investment will allow me to be able to finest song and you can all of our promise me to interrupt illegal crime guns typing the area otherwise leaving here being always going crime within the other places, thus we’re enthusiastic about you to definitely efforts,” Mayor Ginther told you. COLUMBUS, Kansas — Gran Andrew J. Ginther provides suggested a great step 1.74 billion funding in public places security and you may vital community system. The newest 2023 Funding Budget has step one.step one billion inside the new investment serious about building safer teams. “We would like to hear away from people about how precisely the metropolis is finest submit critical characteristics,” told you Council Chairman Specialist Tem Age Brown, who’re making the fresh council from the early the coming year so you can control their the newest post since the Chief executive officer and you will chairman of the YWCA Columbus. Columbus Urban area Council usually keep some public hearings beginning Monday and continuing across the next 2 weeks to review and you may receive social opinions to the Gran Andrew J. Ginther’s advised 2023 operating budget. Saturday during the Urban area Hallway, where individuals divisions “can give presentations for the possible plans to by taking left finance.”

The original tranche away from redistributed money went along to only 89 state and regional grantees across the country, as well as Columbus and you may Franklin State. To your functions finance being mostly strained, Columbus’ second distinct budget defense to possess 2023 will be the “rainy time fund,” that is projected to own 89.6 million inside it after 2022 once another one million put this season, the brand new finances reveals. The new auditors office interviewed higher Columbus companies about their estimated secluded-works style to possess the coming year, whenever an alternative state laws will need companies to correctly withhold municipal income taxes based on the actual urban centers of its pros. It actually was by 2009 recession one previous Mayor Michael B. Coleman effectively pressed to own voters to improve the newest city’s tax away from 2percent in order to 2.5percent, the most recent height.

These could are lead deposits, you could along with qualify with other deals. But not, be sure to read the small print since you could have other standards along with head put to fulfill prior to claiming your hard earned money. Financial out of America possesses some indication-right up incentives, but unfortunately, you could potentially’t obtain her or him rather than joining an excellent lead put. If you are operator searching for an alternative bank account, make sure you check this out give out of Financial out of America. To be eligible for so it strategy, you are able to earliest need to sign up for one Update Credit (including, the brand new Multiple Cash Card), which is a blend of a credit card / line of credit.

The fresh widescale adoption from reciprocal places has effects for the efficacy of the deposit insurance policies system you to definitely happen subsequent research. Over the years, there is a constant and you can sluggish escalation in their utilize up to 2019, if you have a noticeable increase because of a regulating change, because the would be chatted about later on this page. A lot more striking, yet not, is the higher boost in 2023 due to the newest financial turmoil one spring.

However,, once we alluded earlier, that it meaning isn’t common certainly one of all the banks. The new cards have a fairly large annual fee; yet not, straight down compared to most other similar superior notes. Cardholders along with appreciate perks such as 300 inside statement credits for bookings thanks to Money One Traveling, up to an excellent 120 credit for the Worldwide Entryway or TSA PreCheck and usage of come across airport lounges. You can also partners so it using their Full Accessibility Examining welcome incentive, to put a total of 500 on the pouch. So it offer can be obtained in order to both the newest and you can established people; but not, various other laws get pertain, so be sure to look at the disclosures during the connect lower than. They usually have shuffled all of the prior tiers and you may reinstated the newest sections to own individuals with 7+ rates to pay.

Whether you’lso are new to travel advantages or if you just want to add a sleek advantages card to your merge, the brand new U.S. It comes having a decreased annual commission and aggressive incentive advantages to the gas, travelling, food, and you will groceries good for beginners. The main city You to definitely Campaign X Rewards Charge card includes a 75,one hundred thousand kilometer invited bonus. All you need to do in order to qualify is build 4,100000 property value orders within this 90 days out of opening the brand new account. Overall, when you’re a new Funding One individual offers consumer, this is an advantage which have easy requirements if you have certain dollars which can be really worth capitalizing on.

| Dolar | 36,4405 | % 0 |

| Euro | 38,2075 | % 0.09 |

| Sterlin | 46,0620 | % 0 |

| ,00 | % 0.00 | |

| ,00 | % 0.00 | |

| Çeyrek | 5.764,00 | % 0,09 |

| G. Altın | 3.453,67 | % 0,46 |

| BIST 100 | % | |

| % 0.00 | ||

| B. Cash | ,00 | % 0.00 |